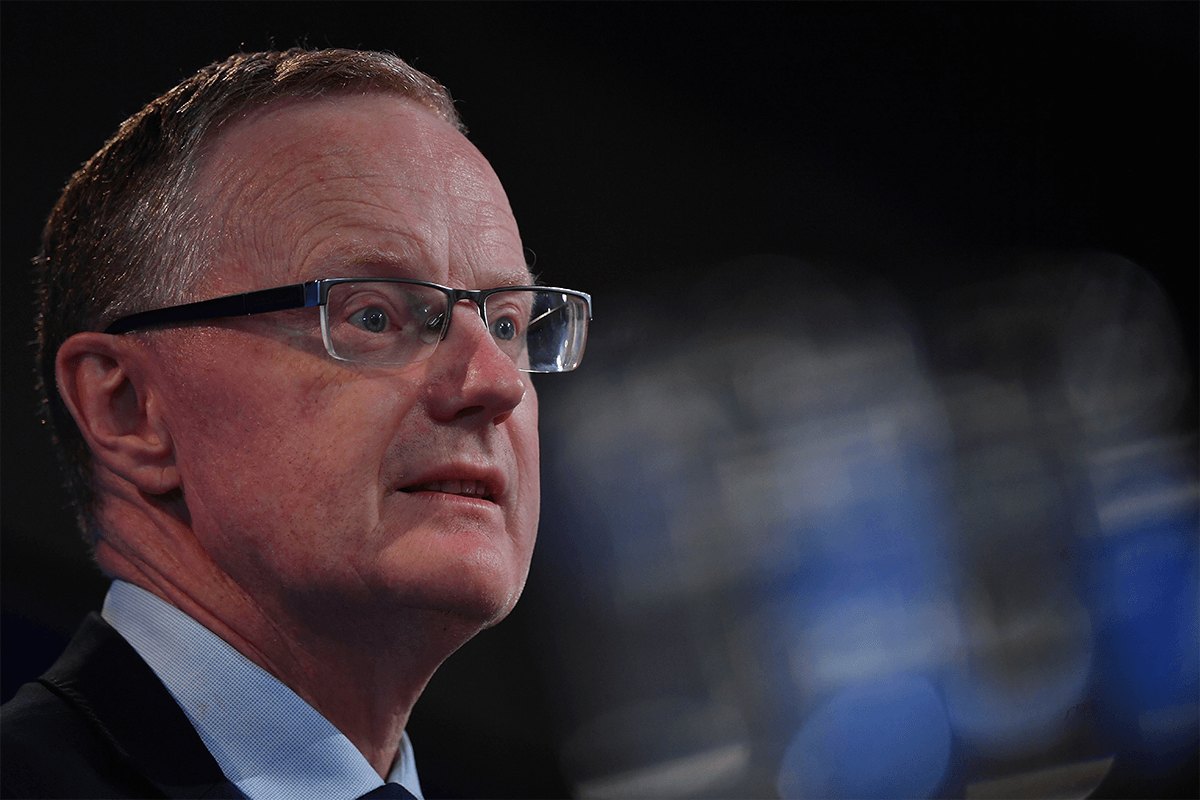

RBA boss ‘sorry that people listened’ to interest rate advice

Reserve Bank governor Philip Lowe has again apologised for getting it wrong on interest rate rises.

Appearing before a Senate estimates hearing this morning, Dr Lowe said it was “regrettable” that the RBA gave unclear guidance.

As late as November last year, Dr Lowe said it was unlikely the cash rate would increase until 2024.

It led to hundreds of thousands of Australians taking out mortgages six or more times their incomes, some with deposits as low as 10 per cent.

Since then, the cash rate has jumped by nearly three per cent, leaving many mortgage-holders under pressure.

“I’m sorry that people listened to what we’d said and acted on that, and now find themselves in a position they don’t want to don’t want to be in,” Dr Lowe said.

“But at the time, we thought it was the right thing to do and I think looking back, we would have chosen different language.

“People did not hear the caveats in what we said. We didn’t get across the caveats clearly enough, and the community heard 2024. They didn’t hear the conditionality.

“That’s a failure on our part, we didn’t communicate the caveats clearly enough, and we’ve certainly learned from that.”

Image: Sam Mooy/Getty Images